The inventory list of unused receipts and invoices BIR form serves as a crucial tool for businesses and individuals alike, providing a comprehensive record of all unused receipts and invoices. This guide delves into the purpose, legal requirements, design, procedures, maintenance, audit considerations, best practices, and illustrative examples related to this essential document, ensuring effective management and compliance.

Inventory List of Unused Receipts and Invoices BIR Form

An inventory list of unused receipts and invoices BIR form serves as a comprehensive record of all unused official receipts and invoices issued by businesses and self-employed individuals. It plays a crucial role in ensuring compliance with tax regulations and facilitating efficient tax administration.

Maintaining an accurate and up-to-date inventory list is a legal requirement in many jurisdictions. It enables tax authorities to verify the accuracy of tax returns and assess the taxpayer’s compliance with tax laws.

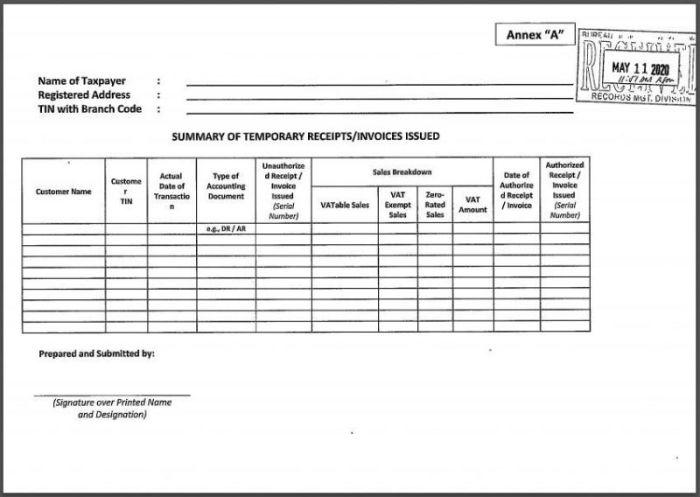

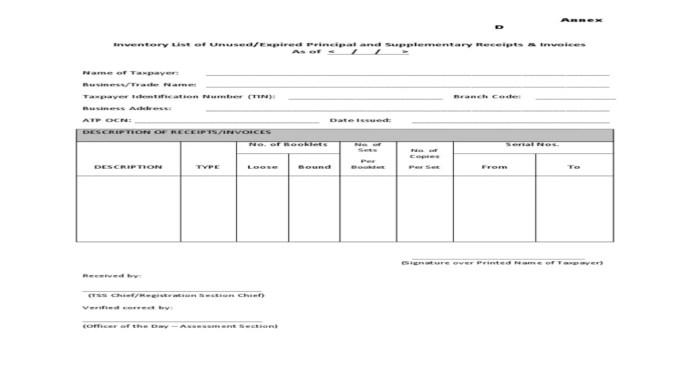

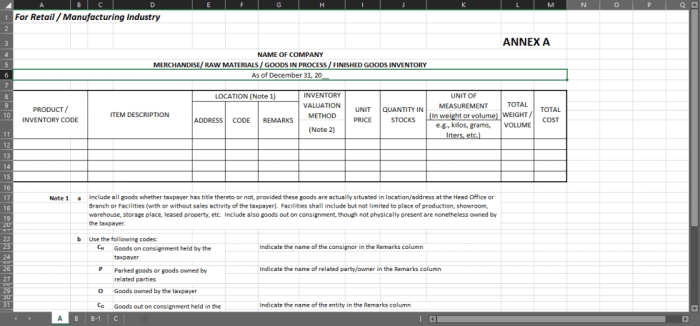

BIR Form Design and Structure

The BIR form used for inventorying unused receipts and invoices is typically designed to capture specific information about each document, including:

- BIR serial number

- Invoice or receipt number

- Date of issuance

- Name and address of the recipient

- Amount of the transaction

Filling out the form accurately is essential to ensure the validity and reliability of the inventory list.

Procedures for Inventorying Unused Receipts and Invoices

Conducting an inventory of unused receipts and invoices involves the following steps:

- Gather all unused receipts and invoices.

- Sort the documents by type (receipts and invoices) and date.

- Record the necessary information from each document onto the BIR form.

- Review the inventory list for accuracy and completeness.

Maintaining and Updating the Inventory List, Inventory list of unused receipts and invoices bir form

Regularly maintaining and updating the inventory list is crucial to ensure its accuracy and relevance. This involves:

- Adding new unused receipts and invoices to the list as they are issued.

- Removing any used or voided documents from the list.

- Verifying the accuracy of the list periodically.

Audit and Compliance Considerations

The inventory list of unused receipts and invoices plays a significant role in audit and compliance processes. Tax authorities may request the list during an audit to verify the taxpayer’s compliance with tax laws.

Preparing for an audit related to unused receipts and invoices involves:

- Ensuring the accuracy and completeness of the inventory list.

- Having supporting documentation for any used or voided documents.

- Cooperating with tax authorities during the audit process.

Best Practices and Recommendations

Effective management of unused receipts and invoices requires the following best practices:

- Store unused receipts and invoices securely to prevent loss or damage.

- Use a system to track the issuance and use of receipts and invoices.

- Train staff on the proper handling of receipts and invoices.

- Regularly review and update the inventory list to ensure accuracy.

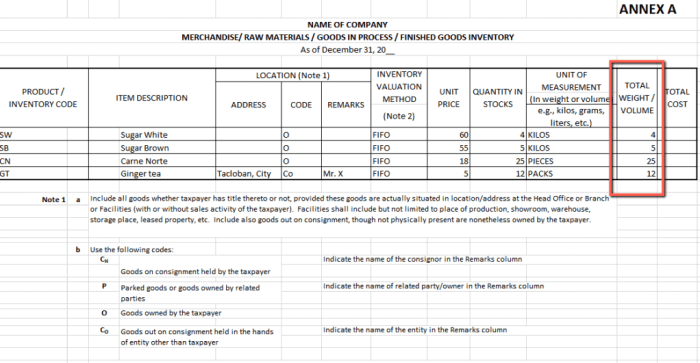

Illustrative Examples and Case Studies

An example of an inventory list of unused receipts and invoices includes:

| BIR Serial Number | Invoice/Receipt Number | Date of Issuance | Recipient Name | Amount |

|---|---|---|---|---|

| 1234567890 | INV-000001 | 2023-01-01 | John Doe | $100.00 |

| 9876543210 | RCPT-000002 | 2023-02-01 | Jane Smith | $50.00 |

Common Queries

What is the purpose of an inventory list of unused receipts and invoices?

An inventory list of unused receipts and invoices provides a record of all unused receipts and invoices issued by a business or individual, ensuring accurate accounting and compliance with legal requirements.

What are the legal requirements for maintaining an inventory list of unused receipts and invoices?

Legal requirements vary depending on jurisdiction, but generally, businesses are required to maintain an inventory list of unused receipts and invoices for a specified period to facilitate audits and ensure compliance with tax regulations.

How do I fill out a BIR form for inventorying unused receipts and invoices?

The BIR form for inventorying unused receipts and invoices typically includes sections for recording the receipt or invoice number, date, amount, and reason for non-use. It is important to fill out the form accurately and completely.